HCMC – Vietnam’s steelmaker Hoa Phat Group JSC (HOSE: HPG) posted a significant rise in second-quarter profit, driven by the strong performance of its steel segment.

The firm’s second-quarter revenue rose by 34% over the same period last year to VND39.9 trillion. Its after-tax profit in the quarter skyrocketed to a whopping VND3.32 trillion, up from VND1.45 trillion recorded as net profit in the second quarter of 2023.

Steel products accounted for 96% of Hoa Phat’s Q2 revenue and 91% of its net profit. In April-June, the firm produced 1.27 million tons of construction steel, up by 33% versus the previous quarter. However, hot-rolled coil (HRC) consumption fell by 10% to 724,000 tons. The company maintained a 38% share of the domestic construction steel market.

The decline in HRC production was attributed to weak domestic and export markets, along with an increase in low-cost HRC imports to Vietnam. These imports rose to six million tons in the first half of this year, exceeding market growth and pressuring Hoa Phat’s domestic HRC sales.

In the first half of 2024, the steel firm reported revenue of VND71 trillion and after-tax profit of nearly VND 6.2 trillion.

Hoa Phat is working on its Hoa Phat Dung Quat 2 Iron and Steel Production Complex project, which will produce 5.6 million tons of HRC annually.

The project is 80% complete for phase one and 50% for phase two. The first phase is expected to roll the first products by the end of 2024. Once fully complete, Hoa Phat Dung Quat 2 will increase Hoa Phat’s crude steel capacity to over 14 million tons per year.

Wrapping up the trading session today, August 5, its HPG shares dropped by 4.77% over the previous to VND25,950, with a substantial trading volume of 45.6 million shares, the highest on the Hochiminh Stock Exchange.

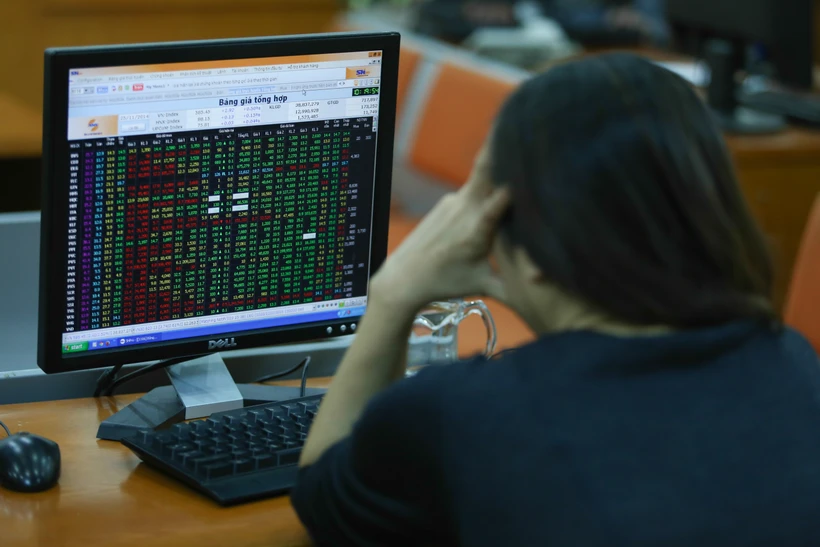

Vietnam’s benchmark VN-Index fell sharply on Monday, losing 48.53 points, or 3.92%, from the previous day’s close amid panic selling, at 1,188.07 points. Losers far outnumbered winners by 448 to 24, including 91 stocks plummeting to their floor prices.

Trading volume and value improved by 48.5% and 45.1% over the session earlier, respectively, with 1.04 billion shares worth around VND23.8 trillion changing hands. Block deals contributed 95.55 million shares valued at over VND2.52 trillion to the overall value.

The VN30 Index, which tracks the 30 largest-cap stocks, dropped 48.9 points, or 3.82%, to 1,232.11 points, as all bluechips in this basket were decliners.

GVR decreased the steepest, plunging to its floor price of VND30,100, with roughly 4.2 million shares matched.

VRE and HDB slid by 6.13% and 6.41%, respectively, while others decreased by 1.67% to 5.63%.

Lenders VCB and BID had the most significant impact on the main index, causing it to lose 2.5 and 2.3 points, or 2.03% and 3.46%, respectively. GVR, TCB and HPG also weighed heavily on the index, driving the index down by more than two points each.

The HNX-Index also suffered from the bearish market sentiment, dipping 8.85 points, or 3.82%, to 222.71 points, with 33 advancers and 171 decliners. Trading volume on the northern market totaled 82.65 million shares valued at VND1.5 trillion.