In the aftermath of Evergrande’s debt bombshell, real estate enterprises with a healthy balance sheet combined with a strong land bank will have a good opportunity to develop and dominate the market.

- CT Group does its bit to ensure poor people do not suffer from hunger or illness amid Covid

- CT Group shares experiences in fighting COVID-19

Media outlets for many days have continuously covered the “debt bombshell” at Evergrande imminent to go off. The world’s most indebted real estate group is saddled with more than US$305 billion in debt and has warned repeatedly that it could default. Currently, Evergrande’s stock and bond prices are crashing, declining 90% from their peak in 2020. Shareholders and 70,000 investors have almost lost everything as the Chinese government is likely to let Evergrande handle it on its own under the market mechanism.

According to CNBC, real estate companies under financial stress in China are also in danger of collapse following Evergrande. The international press also lists a series of other large enterprises that will be in the spotlight of the market with credit stress after sales of house and debt credit decline. The cooling of the housing market would expose the Chinese economy to serious risks, as the real estate industry makes up nearly 30% of China’s GDP and is one of the industries that consume the most materials and use the most labor.

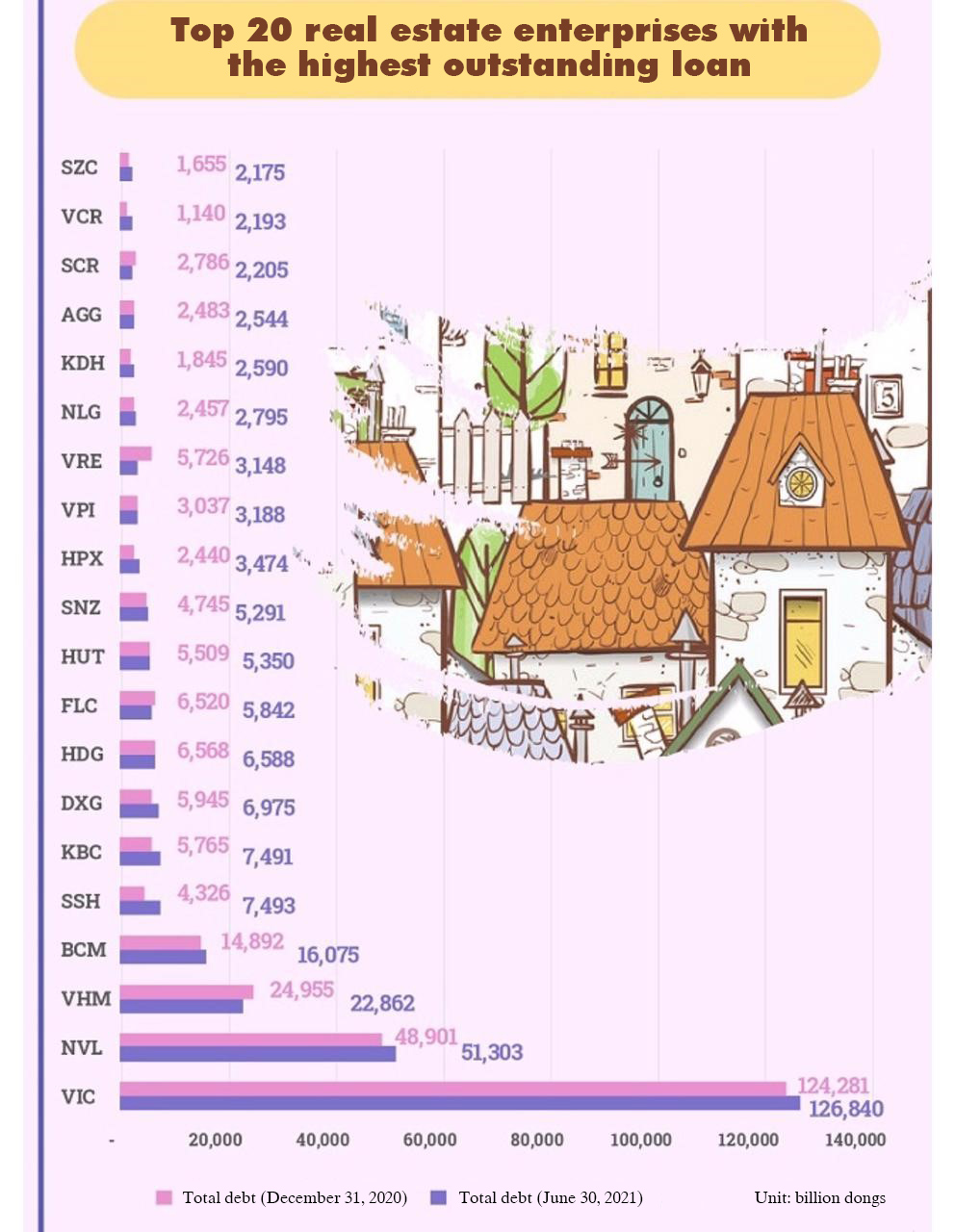

From the “debt bomb” Evergrande, many people have recently started to look at the Vietnamese real estate market. Data from the Vietnam Bond Market Association (VBMA) shows that, in the first eight months of the year, real estate companies mobilized the second most bonds with a total issuance value of VND107.98 trillion. Notably, about 21.6% of bonds issued by real estate enterprises are unsecured or mortgaged by shares.

In a document sent to the State Bank of Vietnam at the end of August, the Ho Chi Minh City Real Estate Association (HoREA) acknowledged that, at present, the lack of cash flow is the greatest and most worrisome difficulty for businesses in the industry. Many units no longer have money to pay interest and debts, nor have cash to maintain business and support and retain employees.

The warning bells from Evergrande and the “mountain of debt” are weighing heavily on many businesses, prompting market observers to agree with a view that Vietnam’s real estate industry is likely to be markedly polarized. Those enterprises with extremely high financial leverage, and capital from China, including Hong Kong, and having many Chinese customers will be more difficult. On the contrary, the enterprises with harmonious and balanced outstanding loans, combined with a strong land bank and seizing opportunities for extensive digital transformation will have good development opportunities.

In a short time, the market will cannon more attention onto companies with less debt and lots of land fund. Among them, there are notable names such as Khang Dien, Nam Long, and CT Group among others.

Khang Dien currently has a total debt of VND2,590 billion, or only 0.3 times its equity. This enterprise has almost no pressure to pay debts in its development plan, and has a land bank of 614 hectares available for tapping between now and 2025.

Nam Long, bearing VND2,795 billion of debt, or only 0.29 times of its equity, plans to spend VND2,000 billion to expand the land bank in 2021, serving the strategy of becoming a developer of a complex urban area.

Meanwhile, CT Land (a member of CT Group), owning a land bank of over 1,000 hectares in the city, develops many products with high absorption rates. Recently, this enterprise also announced the search results from the Credit Information Center (CIC) of the State Bank of Vietnam, which shows CT Land has not had outstanding loans in the past 5 years and is still capable of completing many projects. This is also one of the rare enterprises operating in the real estate industry that has not had outstanding loans in the past 5 years.

In a report on the market outlook at the end of this year, a representative of Savills Vietnam said that the Ho Chi Minh City market still has advantages in terms of demographic background and scarcity of supply. Therefore, the positive point is that the demand for residential real estate is still quite well recorded. According to experts, owners and individual investors are taking advantage of this time to prepare business plans after the market is reopened. When the market gradually gains sufficient momentum and learns from the Evergrande event, products from the enterprises with harmonious and balanced outstanding loans and a strong land bank will have better resilience.