HCMC – Ba Ria-Vung Tau House Development JSC (HOSE: HDC) plans to issue 20 million shares at a price of VND15,000, a discount of 49% from the current market price of VND30,500 as of today, April 15.

HDC intends to sell these shares to existing shareholders through a rights issue in which shareholders have the right to purchase 148 new shares for every 1,000 shares held.

By issuing these shares, the company expects to raise nearly VND300 billion. This will increase its charter capital to over VND1.55 trillion, with the total number of outstanding shares reaching over 155.1 million.

The registration and payment period for share acquisition will run from May 10 to June 5. The net proceeds from the sale will be used to repay principal and interest on eight credit contracts of the company.

As of December 31, 2023, HDC’s total outstanding debt under these contracts amounted to nearly VND958 billion.

This share issuance plan was approved by the firm’s annual general meeting of shareholders held in April. The meeting also agreed to issue bonds worth VND500 billion for business activities.

This year, HDC looks to book revenue of VND1.65 trillion and after-tax profit of VND424 billion, up by a sharp 147% and 222% over 2023.

Last year, the firm faced challenges and met only 38% of its revenue plan and 27% of its net-profit plan, at VND672 billion and VND132 billion, respectively.

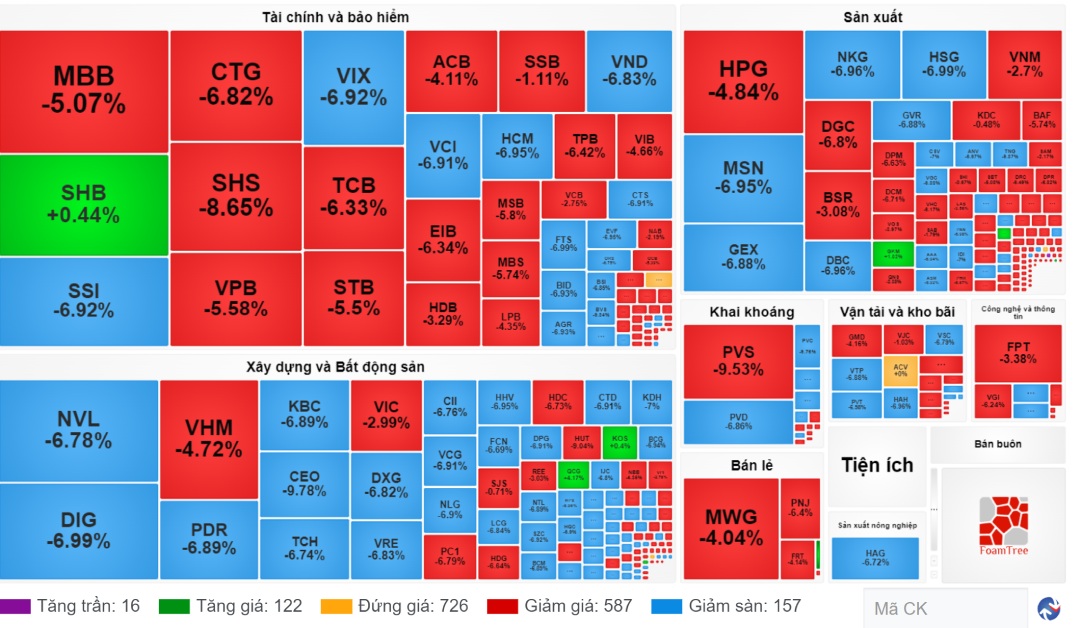

The benchmark VN-Index plummeted nearly 60 points on Monday, as strong selling pressure triggered widespread panic selling in the afternoon session, with over 112 stocks hitting their floor prices on the Hochiminh Stock Exchange.

The HCMC exchange saw 475 losers and 40 winners. At the close, the VN-Index lost 59.99 points, or 4.7%, to 1,216.61 points. The VN30-Index, which groups 30 largest-cap stocks, ended 56.84 points lower to 1,227.90 points

Among them, 29 bluechips were decliners, including six hitting their floor prices: MSN, BID, SSI, BCM, GVR, and VRE. SHS was the sole gainer as it improved by 0.44%, while POW was the only stock that dipped below 1%.

SHS took the lead by liquidity on the southern market, with more than 98.7 million shares changing hands. Developer NVL followed closely behind, with a matching volume of over 71.6 million shares. NVL fell to its floor price, closing at VND16,500.

Today’s session saw the sharpest decline in nearly two years. The last time the VN-Index lost over 60 points was on May 12, 2022, with a drop of nearly 63 points, or a 4.82% plunge.

Securities stocks spearheaded the market’s decline, with only a handful of small-cap stocks managing to stay afloat. VIX was the hottest stock in the sector, with a staggering 43.87 million shares traded.

Real estate shares came under pressure due to selloffs, with property developers such as DIG, TCH, DXG and PDR plunging to their floor prices, with a trading volume ranging from 18.8 million shares to 35.6 million shares.

On the Hanoi Stock Exchange, decliners outnumbered advancers by 172 to 35, including 31 stocks hitting their floor prices. The HNX-Index dropped by 11.62 points, or 4.82%, to 229.71 points.

Trading volume and value on the Hanoi exchange doubled that of the previous session, with 163.26 million shares worth nearly VND3.5 trillion traded.