Mr. Hirai Shinji, chief representative of the Japan External Trade Organization (JETRO) in HCMC, told the Weekly about the investment and business strategy of Japanese businesses in Vietnam after JETRO’s recent announcement of the results of its survey.

Q.: Japan fell out of the top three foreign investors in Vietnam in 2019 after many years in the rank of leading investors. Are Japanese businesses changing their investment directions?

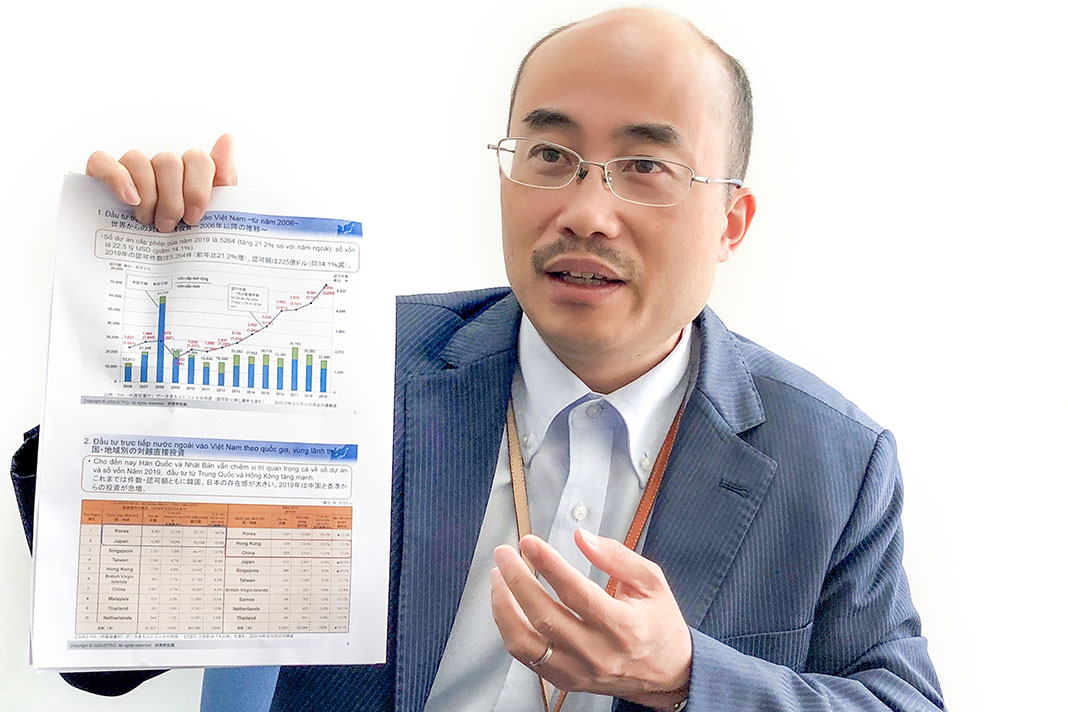

A.: It’s true that Japan fell to the fifth position in fresh investment in Vietnam last year (below South Korea, Hong Kong, China and Singapore—please see Table), but I think that there is no [Japanese] investment shift to other countries. The number of new investment projects and the capital increase by Japanese enterprises remained high, with 435 projects, 17 higher than the figure in the year earlier, with total registered capital of more than US$1.8 billion.

These figures show that there are many small and medium investment projects. I think that this is also the investment direction of Japanese enterprises in the upcoming time, except for very few big projects in areas like urban development and power.

It should be mentioned that the Sino-U.S. trade war propelled an upsurge in Chinese investment in Vietnam in 2019 and put it in the top position. Hong Kong ranked second, with its fresh investment rising 2.4 times from the year earlier, and China third, with its fresh investment up 1.65 times (Table).

But the survey shows that the rate of Japanese enterprises planning expansion in Vietnam in 2019 dropped to 63.9% compared with nearly 70% in 2018. What’s your comment?

The rate of 63.9% shows a slight fall, but it is the highest rate among Japanese enterprises in the ASEAN. Even in the markets which have the rates of Japanese enterprises earning higher profits than in Vietnam, such as the Philippines and Indonesia, the rates of Japanese enterprises planning expansion are only 51.8% and 50.7%, respectively.

These figures show that Japanese enterprises are still confident in the growth potential in Vietnam. The reason for the fall, I think, is mainly the global economic slowdown in 2019. Since the market has declined, the operations of Japanese export processing enterprises in Vietnam have also followed suit.

At the present time, the negative impact of the widespread Covid-19 outbreak may affect the business expansion plans of many businesses.

Over the long term, most big Japanese manufacturing enterprises are already present in Vietnam and they will pour more capital into the manufacturing sector here in the country. Up to 75% of enterprises set up over the past five years said they wanted to expand business in Vietnam. This is a quite high rate compared with other countries in the region.

In your own view, what are the factors in Vietnam which attract Japanese enterprises?

Japanese enterprises highly value the size and the growth of the Vietnamese market, in addition to political stability and a quite attractive living environment to expatriates.

Though the labor cost in Vietnam is rising, it only affects export processing enterprises. There are many Japanese enterprises aiming at the domestic market in Vietnam.

Can you elaborate more on this trend?

Over three years ago, Thailand was a very attractive market to Japanese investors. But many investors have recently turned to Vietnam. I think that they have realized the potential of a market of nearly 100 million people with rising income, and a majority of them are young consumers.

Japanese investment in non-production sectors in Vietnam has increased significantly in recent times, most notably from retailers like Aeon, Family Mart, MiniStop and 7-Eleven. The store opening of famous fashion brand Uniqlo in HCMC late last year and recently in Hanoi can attract the interest of many other Japanese businesses in Vietnam. I think that Japanese investment will continue rising in the upcoming time.

Apart from production in Vietnam to tap the domestic market, how do Japanese enterprises prepare for exporting goods to Vietnam?

Japanese goods currently serve a small group of high-end customers in Vietnam. Most Japanese businesses are aiming at the middle group, not only in Hanoi and HCMC, and are studying the markets in other localities. They have market surveys through the retail systems of other Japanese businesses or their own distribution systems in Vietnam.

The survey shows that many Japanese businesses expect they can realize what Acecook has achieved in Vietnam, including developing many products suitable to various kinds of customers and brand popularity.

What do you think should be done to improve the conditions to attract Japanese investment in Vietnam?

The survey results show some concerns of Japanese enterprises in doing business in Vietnam, most notably, the incomplete legal system and its unclear operation. The tax procedure and mechanism are complicated and changeable.

Besides, the labor cost in the manufacturing industry is rising and the localization rate is low. To address the rising labor cost, some enterprises have plans to increase investment in technology and robots.

I think these are issues which Vietnam should pay attention to.

Reported by Quoc Hung