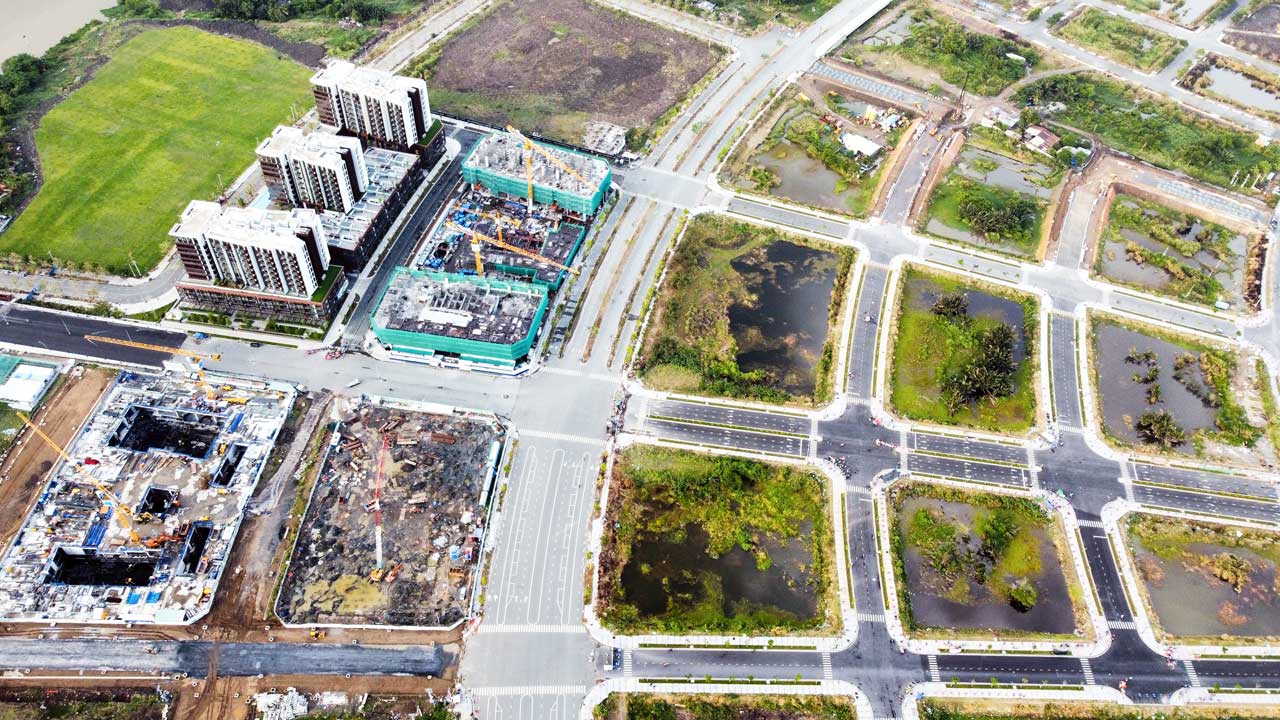

Although the cancelation of auction winning bids and the purchase of auctioned assets is not new, the auctions of land lots in the Thu Thiem New Urban Area in HCMC’s Thu Duc City have triggered multiple controversies over the impact of the winning auction prices on the prices of the real estate market, especially the appraisal of properties, as the winning auction prices were found to be artificially high.

Winning auction prices and… cancelation of auction winning bids

One of the reasons, and also a major one, for the cancelation of auction winning bids is the high prices. However, the high prices are a result of the winners’ assessment of the value of the assets put up for auction.

Obviously, winning enterprises must pay the penalty for canceling auction winning bids and face sanctions and bear responsibility for their cancelations. However, the refusal to buy the auctioned land should not indicate that the winning auction prices do not accurately reflect its value.

Auctions of land use rights and the winning auction prices are like that. In other words, the winning auction prices of land lots do not affect land prices, but impact the insight and assessment of parties in the market about the prices.

Theoretically, the winning auction prices are agreed upon by sellers and buyers. The prices represent buyers’ expectations. If the buyer is just a person or a group of people, the prices reflect the demand of a minority group and cannot be considered as market prices. The winning auction prices will become common market prices if they are popular.

The failure to realize this issue or deliberately ignore it may negatively affect the real estate and financial markets. Therefore, warnings about the negative impact, especially the possibility of the establishment of virtual prices in the property market following the unthinkably high winning bids of land use rights, should be critically analyzed.

There’s no denial that the high winning prices will create a certain impact on the operation of the real estate market, especially after auctions, as auction winners may decide to cancel the deals. Bidders in land auctions may set prices based on the value of the land lots put up for auction, and the unethical usage of the auction results to inflate the land prices is beyond the expectations of bidders. Therefore, it is important to analyze in detail to realize issues and remove shortcomings and improve asset auction regulations.

Shady auctions

In reality, the land auctions where winning bids are unreasonably high may result in the prices of mortgaged properties soaring, leading to an unreasonable hike in loans although lenders have their own principles to appraise land. However, this negative impact may not be caused by bidders and auction winners.

The negative impact is caused by bid winners if they win the bids by competing unfairly. In case there are no signs of malpractices, auction winners should not be blamed for causing a negative impact on the real estate market. Therefore, it is unfair for auction winners if irregularities during auctions are entirely attributed to them. This will also hinder auctions.

For example, bidders cannot be accused of pushing property prices up unreasonably or affecting the accurate appraisal when their bids are higher than the previous property prices as the nature of auctions is to reach the highest possible prices. Thus, the accusation of auction winners based on this is unconvincing and affects the legitimate interests of auction winners and asset sellers. Moreover, the accusation may make those who really want to participate in auctions in the future hesitate as they do not know what to do to prevent irregularities in the real estate market. Of course, bidders do not expect to lose opportunities to win auctions.

It is impossible to ensure that all bidders and auction winners are honest. The reality has shown that some bidders have used tricks. For example, auction winners and other bidders have conspired against other bidders in an unhealthy manner to buy assets at low prices. To buy the assets at lower prices, they reach a deal that one of them will set a high price and the others will set lower prices. However, when the person setting the high price wins the auction, he/she will refuse to sign the contract to buy the auctioned assets and the assets will be sold to the person who sets the second highest price, which is much lower than the winning price, the market price, and the price which should have actually been reached through the auction. Thus, the high or low winning auction price is not a problem, but it is the bidders’ collusion to buy assets at low prices that is the issue. In other words, the winning price is not a foundation to determine violations.

To cope with the issue, regulations on requirements for auction winners have been amended and supplemented. Those setting the second highest price would no longer automatically become auction winners, but they must meet the requirement that their bids plus their deposits must be equal to the winning auction prices as pursuant to Article 51 of the 2016 Law on Bidding.

This solution has partly prevented the collusion to pump and dump winning auction prices. Compared with regulations on handling violations, this preventive regulation is less costly as violations do not need to be proven.

Solutions

Regulations on asset auctions must be based on the principle that auctions of assets encourage the participation of many buyers, especially those with a good financial capacity. Conditions and ways to place responsibility on bidders should take into account risks of a hindrance to those who want to buy auctioned assets.

Therefore, one of the most important principles in bidding as stated in Articles 6 and 7 of the 2016 Law on Bidding is that the bidding process must protect the legitimate interests and rights of people whose assets are put up for auction as well as bidders and auction winners.

With these above-mentioned possible irregularities during auctions, the State should come up with various solutions, of which the issuance of legal solutions is vital. These legal solutions need careful studying but should ensure that:

First, the winning auction prices may not be the market prices or prices popular in the market. It is not unreasonable for the winning auction prices to be inequivalent to the market prices.

Second, regulations to prevent the use of bids which do not reflect the market prices as a foundation for the price appraisal should be worked out. Of which, criteria to determine the market prices and popular prices in the market must be established.

Third, the law should not regulate maximum bids. Setting the maximum bids goes against the nature of auctions, and is unfeasible and unnecessary. If the State wants to set the maximum prices, it can compel the use of descending-bid auctions. Furthermore, other countries have no direct or indirect regulations on the maximum bids. Regulations are aimed at ensuring no limits in the competition in auctions and no collusion to create unfavorable prices for assets.

(*) The University of Economics and Law, Vietnam National University-HCMC