Almost US$3 trillion of global trade was secured in 2021 by trade credit insurance. Also known as accounts receivable insurance or export insurance, trade credit insurance plays a crucial role in enabling trade flows throughout the world by protecting businesses that offer credit to B2B customers.

In addition to credit risk mitigation, trade credit insurance can provide businesses of all sizes with a range of additional benefits from improved access to finance, to real-time market intelligence. Indeed, credit insurance can be such a valuable tool for businesses that the Vietnamese Ministry of Finance began actively encouraging Vietnamese businesses to secure their trade with credit insurance as long as ten years ago.

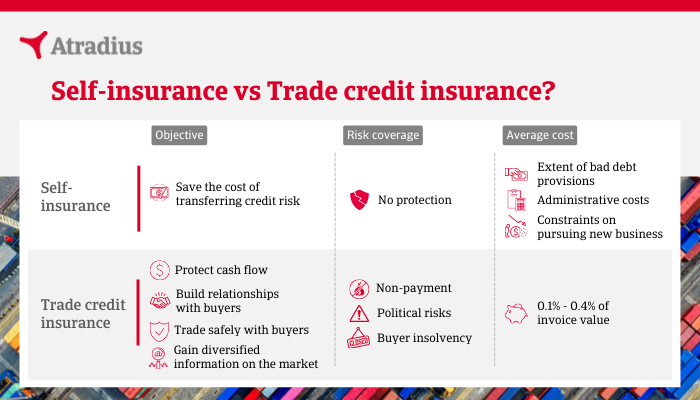

However, despite this, many businesses in Vietnam (and throughout Asia) are still unfamiliar with credit insurance. Many businesses choose to self-insure and, therefore, lose out on the benefits that credit insurance can bring. So, what exactly is trade credit insurance and why is it a much better option than self-insurance?

What is credit insurance?

Trade credit insurance protects businesses against the risk of unpaid invoices due to default or insolvency, or even political issues. Although terms vary from policy to policy, most insurers cover up to 90% of the invoice amount. Some insurers also offer professional B2B debt collection services as part of the policy, if the service is legally permitted in the jurisdiction where the trade takes place.

What are the benefits of credit insurance?

Risk mitigation and competitiveness

A primary benefit of trade credit insurance is risk mitigation. When covered by a credit insurance policy, you can offer your customer credit terms, safe in the knowledge that you will be paid. However, credit insurance also offers far more than risk mitigation and peace of mind. Your credit insurance policy can give you an edge in a competitive market by enabling you to offer attractive payment terms. In addition, many businesses report that credit insurance gave them the confidence to offer customer credit in international markets.

Access to business intelligence

Credit insurance provides policy holders with access to a wealth of valuable business intelligence. In order to underwrite your policy, your credit insurer will undertake a range of due diligence research into your customer, your industry and your market. This is valuable information and will help you when making strategic sales and business development decisions, as well as creditworthiness assessments of private businesses where financial information is harder to source. What’s more, your credit insurer is likely to have more up-to-date information that other data sources. For example, an insurer will let the policy holders know if their customer is late in paying other suppliers or if their customer’s customer has defaulted, which can be an early indicator of a stressed supply chain.

Increased opportunities for growth

Many businesses feel able to explore new markets and enjoy new growth opportunities that they would not have done without the protection afforded to them by credit insurance. For some, credit insurance allows them to increase their risk appetite and for others credit insurance enables them to respond quickly to a sales opportunity. Recent research undertaken by Atradius in Australia showed that businesses with credit insurance grew twice as fast as Australia’s GDP.

Improved liquidity and access to finance

Businesses without credit insurance can struggle with cash flow, either because of late payments or because of the need to put money by to cover payment defaults. However, businesses with credit insurance will enjoy greater access to working capital to invest in their business and will enjoy greater freedom with strategic planning. This is because they can be confident that they will have the cash flow to enact strategic plans and investments.

Many businesses also use trade credit insurance to improve their access to finance and factoring. This is because banks and other financial organisations view them as lower risk if their accounts receivable are insured. Some banks even insist on third party credit insurance as part of their lending terms.

Are there any downsides of trade credit insurance?

It is arguable that credit insurance has few if any downsides. Some critics suggest credit insurance is expensive. However, when compared to similar financial instruments such as bank guarantees and letters of credit, credit insurance can offer better value for money in most cases.

What is self-insurance?

Self-insurance essentially means that you set aside funds to cover any loss caused by a customer default. This usually involves saving a percentage of every sale to build up a pot of capital that can be used to cover write-offs and ensure business continuity. According to the Corporate Finance Institute, most financial experts suggest businesses should have cash reserves that cover its expenses for three to six months. This is a familiar and basic approach to accounting that most businesses in Vietnam will be familiar with. Certainly, the creation of a contingency fund to cover unexpected costs is a wise approach to business operations and should be part of any sensible business plan.

However, the question is, can you save enough to absorb the hit of a large write-off? What if your primary customer goes bust owing you a big debt? And is it good business practice to have a large cash reserve doing nothing, when you could use it to invest in your business?

Self-insurance: is this old method worth it?

Self-insurance can be high risk

In order for self-insurance to work, businesses need to make sure they have enough funds set by to cover a large loss. Without deep enough reserves, a major payment default could result in a situation they may not survive. What’s more for many businesses, setting aside large enough cash reserves is too challenging and the reality is that opting for self-insurance is effectively choosing to remain uninsured.

Self-insured businesses lose out on value-added benefits

Businesses that choose to self-insure miss out on the value-added benefits of credit insurance. A large international credit insurer has underwriters and risk experts working in every major market, as well as knowledge about the credit risk levels of millions of businesses throughout the world. Policy holders are able to use this knowledge when making strategic decisions over business growth and sales. This is especially valuable when entering into new markets or trading with new buyers where you may not have historic data or previous experience to inform your decision, which may cause you to take a more conservative approach than necessary.

Self-insured businesses have to work harder to cover a loss

If a business has to fall back on bad debt reserves to cover a loss, they will need to generate more sales to offset the loss. This can be costly and will require the generation of far more sales than a business covered by credit insurance. For example, a business operating with a 5% margin faced with a bad debt of VND20 billion will need to generate VND10 billion in sales to cover the loss. If the same business facing the same loss was covered by credit insurance, they would only need to generate VND1 billion in sales, as 90% of the loss would be covered by the insurance. What’s more, if part or most of the outstanding 10% could be recovered as part of the B2B debt collection service, the sustained loss could be further reduced. This in turn means that the volume of sales required to make up the loss would be even less.

Overall, it’s clear that when compared to self-insurance, credit insurance represents a powerful business tool that offers good value for money and a wealth of benefits that range from risk mitigation and business intelligence, to being a driver of business growth.

Written by: Hanh Vu, Country Manager, Atradius Information Services Vietnam Co. Ltd.

About the author: Hanh Vu has extensive experience helping businesses identify domestic and export trade opportunities through active management of credit or trade receivable risks. With more than 15 years of experience in accounting, economic research and business development, Hanh currently heads up Atradius business in Vietnam.

Atradius is a global provider of credit insurance, bond and surety, collections and information services, with a strategic presence in over 50 countries. In Vietnam, Atradius works with its official local partners BaoViet Insurance Cooperation and Tokio Marine Vietnam Insurance Co., LTD to provide customers with timely information about trade credit risks on companies in Vietnam. To learn more: https://atradius.sg

For enquiry: info.vn@atradius.com

Follow Atradius on LinkedIn: https://www.linkedin.com/company/atradiusasia

To learn more about what is trade credit insurance, visit this page: https://baohiemtindungthuongmailagi.vn/