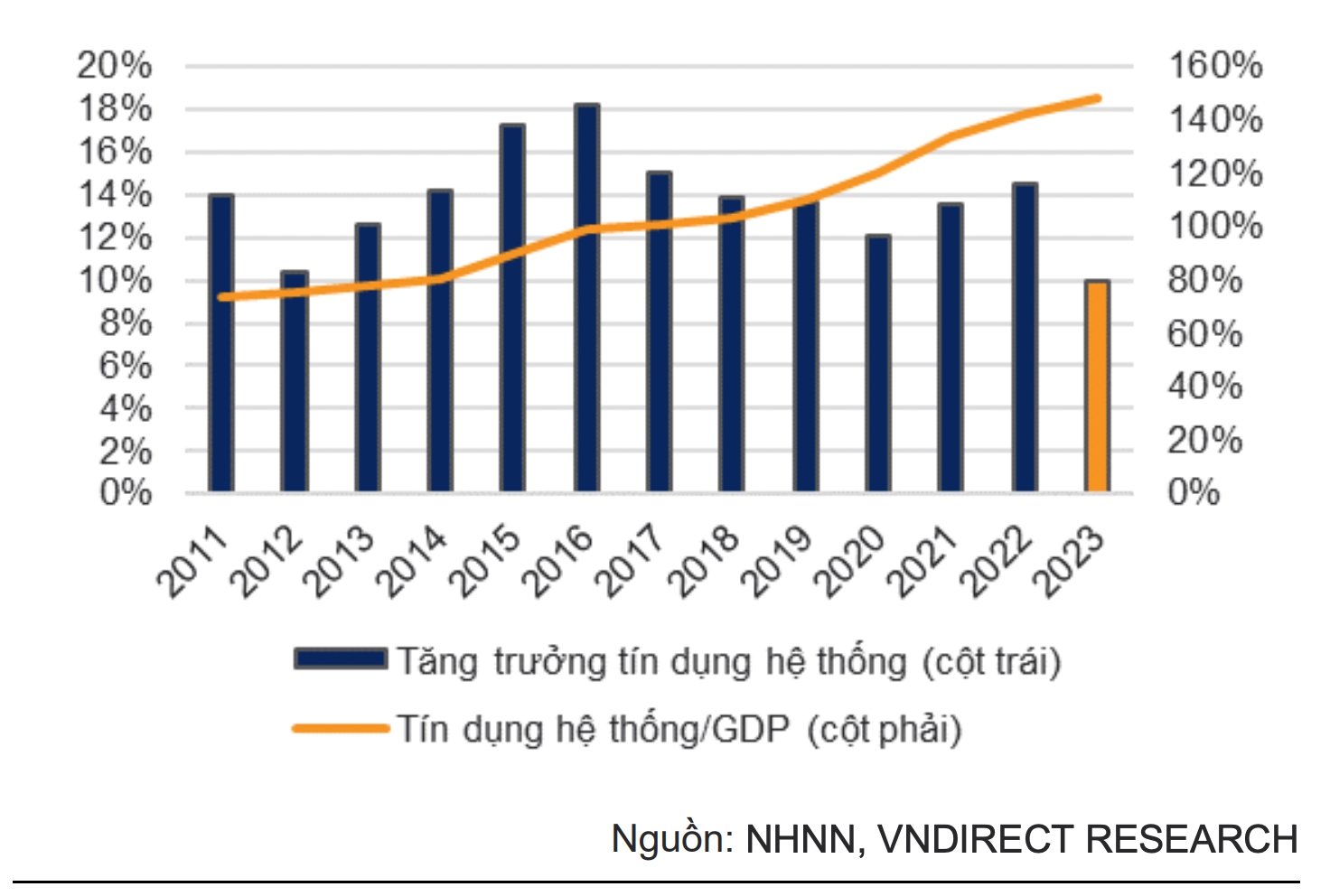

HCMC – Credit may expand a mere 10% in all of 2023, way below the State Bank of Vietnam’s (SBV) target of 14-15%, according to a recent report by the local securities brokerage VNDirect.

The report, released on July 4, assesses the impacts of the SBV’s Circular 06/2023, which imposes stricter lending requirements.

The SBV has cut key interest rates four times over a period of four months. In response, commercial banks have implemented rigorous lending policy.

Data from VNDirect showed that many banks have reduced interest rates for both existing and new loans by 50 to 100 basis points, with even larger reductions for consumer loans with collateral, working capital supplementation, and loans for business operations.

While the substantial cuts of lending rates pose risks, such as the potential allocation of cheap funding toward substandard projects, Circular 06/2023 aims to address these concerns. It highlights the need for increased monitoring of borrowers’ business operations and repayment sources.

These measures aim to mitigate potential risks and prevent the accumulation of non-performing loans in the future.

To bolster lending practices, Circular 06/2023 adds conditions for non-lendable capital needs and requires banks to enhance their loan request approval process for debt restructuring and loans for securities investment and real estate deals. These strengthened disbursement regulations are designed to redirect credit towards high-value projects.

In a bid to address riskier lending practices, the circular introduces three major provisions. First, it restricts lending to customers in potential high-risk groups.

Second, it emphasizes the need for enhanced monitoring by commercial banks when granting loans for securities investment and real estate transactions. Lastly, it establishes a legal framework for loans approved through electronic means.

With tighter lending regulations, there may be a potential slowdown in credit growth in the short term, VNDirect said. As of June 15, credit growth had reached a meager 3.36%, the lowest level in a decade.

However, the long-term perspective assures overall economic safety, VNDirect noted.

Recognizing the increasing demand for electronically approved loans, the SBV has established a legal framework to support these operations. This includes risk assessment procedures, document archiving, and regulations limiting the maximum loan balance per customer at a single lender.

VNDirect views these developments as positive signals for the growth of consumer lending in the market. By the end of 2022, consumer loans provided by consumer finance companies are projected at nearly VND220 trillion, a staggering 82% increase compared to the previous year, accounting for 8.5% of the total outstanding consumer loans within the system.